Standard Deduction 2025 Head Of Household Calculator

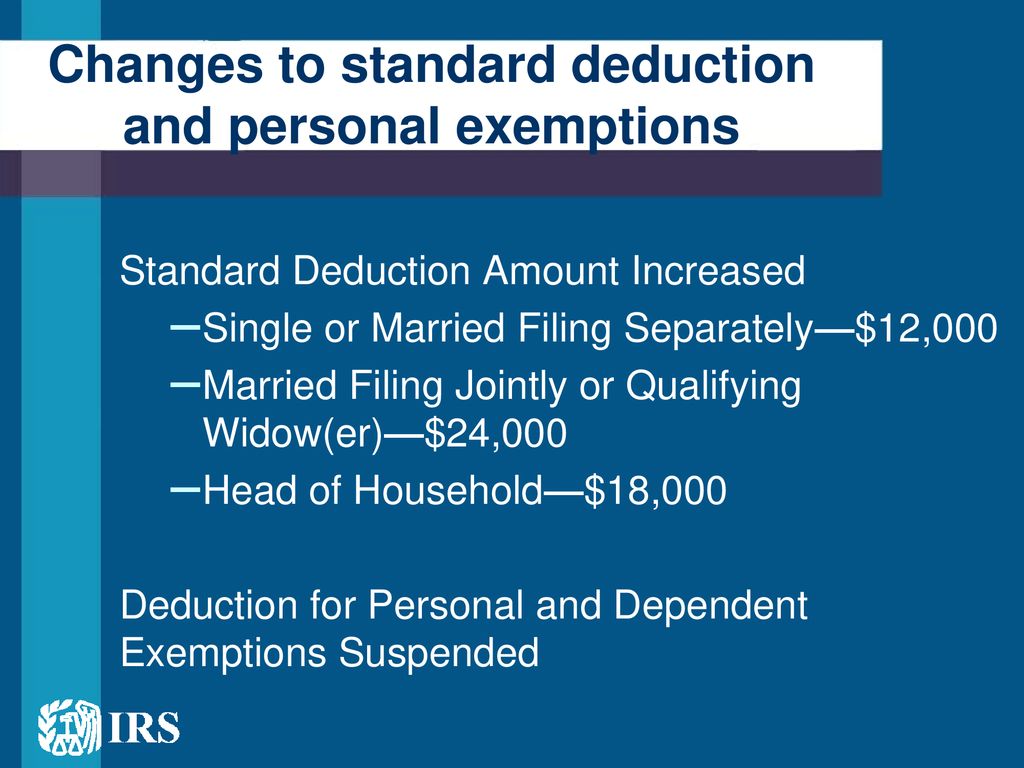

Standard Deduction 2025 Head Of Household Calculator. For taxes filed in 2024, the standard deduction went up once again: For single taxpayers, the 2025 standard deduction is $15,000, up $400 from 2024;

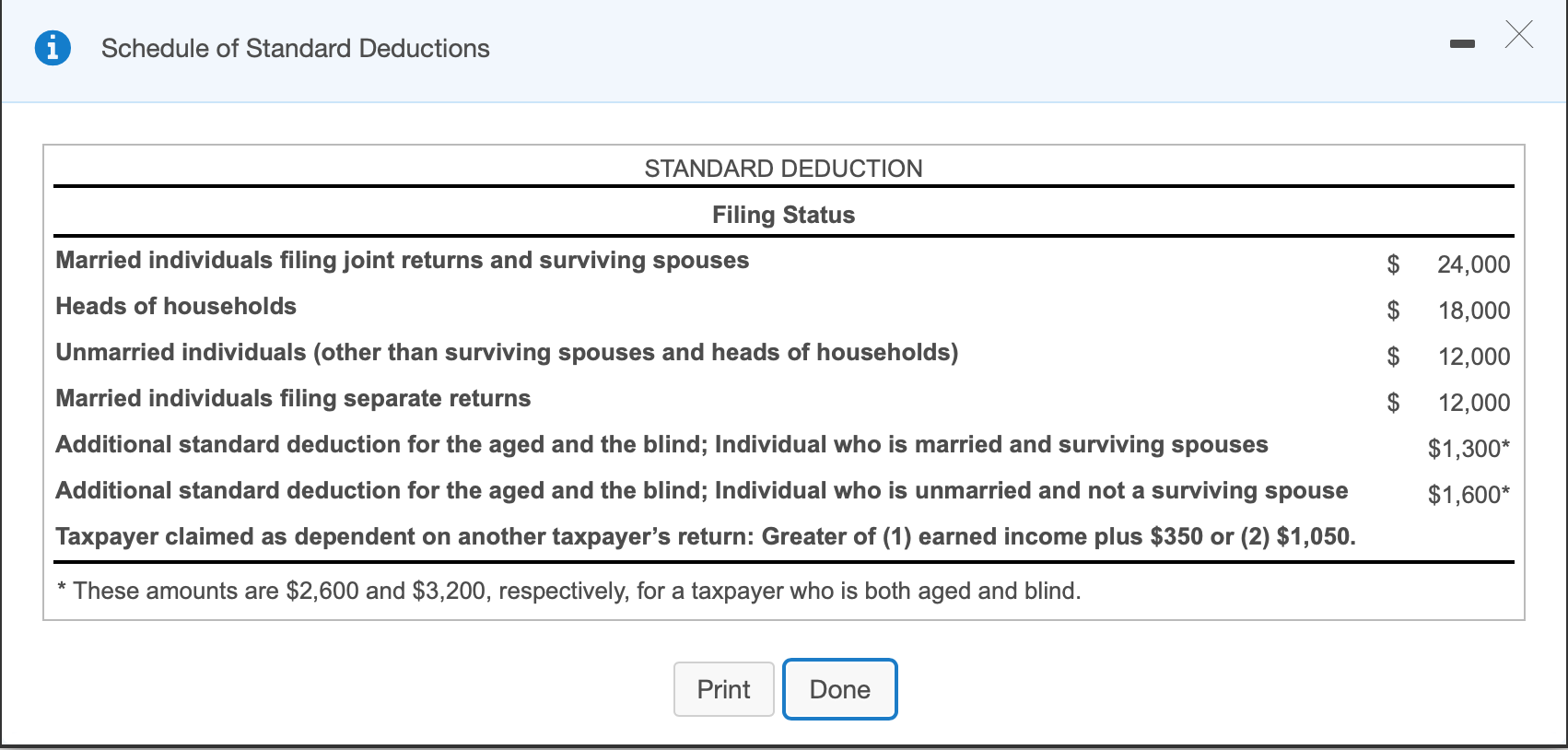

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The standard deduction will increase by $400 for single filers and by $800 for joint filers (table 2).

Standard Deduction 2025 Head Of Household Calculator Images References :

Standard Deduction 2025 Head Of Household Irs Mateo Jackson, To find out the best filing status for you,.

Source: mateojackson.pages.dev

Source: mateojackson.pages.dev

Standard Deduction 2025 Head Of Household Irs Mateo Jackson, Single or married filing separately:

Source: vivianamae.pages.dev

Source: vivianamae.pages.dev

How Much Is The Standard Deduction For 2025 Viviana Mae, (returns normally filed in 2026) the irs has just announced that the standard deduction amounts are increasing between.

Source: dodebmaribeth.pages.dev

Source: dodebmaribeth.pages.dev

Standard Deduction 2025 Vs 2025 Berte Celisse, This calculator takes the gross income entered into the income field and then subtracts applicable deductions and adjustments, such as 401 (k) contributions, hsa.

Source: sadiehiba.pages.dev

Source: sadiehiba.pages.dev

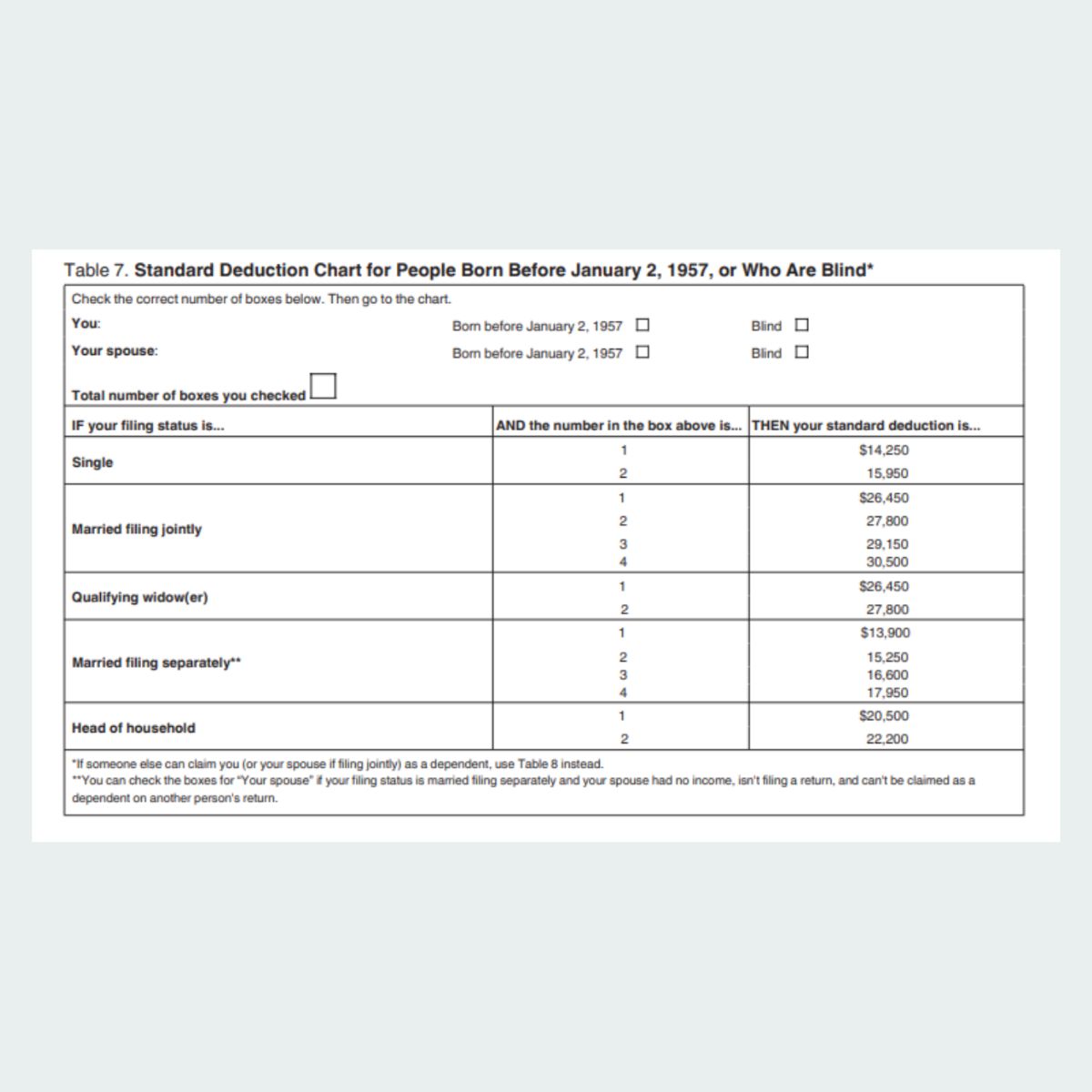

Standard Deduction For 2025 Indian Citizen Sadie Hiba, Seniors over age 65 may claim an additional standard deduction of $2,000 for.

Source: ardythvbrianne.pages.dev

Source: ardythvbrianne.pages.dev

2025 Standard Deduction For Single Over 65 Hope Ramona, Find the 2025 (for money you earn in 2025).

Source: sherhjkphilippa.pages.dev

Source: sherhjkphilippa.pages.dev

Standard Deduction 2025 Married Filing Jointly Calculator Lina Shelby, The standard deduction for couples filing jointly will be $30,000, up $800 from 2024;

Source: lorrainejanderson.pages.dev

Source: lorrainejanderson.pages.dev

Standard Deduction 2025 Tax Brackets Lorraine J. Anderson, Section 206cca of the act, requires for.

Source: ashtonsbbailey.pages.dev

Source: ashtonsbbailey.pages.dev

2025 Tax Brackets Vs 2025 Tax Bracket Ashtons B Bailey, Generally, to qualify to file as a head of household, you have to be unmarried and you have to support a dependent or qualifying relative.

Source: annaspringer.pages.dev

Source: annaspringer.pages.dev

2025 Personal Deduction Head Of Household Anna Springer, Seniors over age 65 may claim an additional standard deduction of $2,000 for.

Posted in 2025